ETH Price Prediction: Bullish Momentum Builds as Institutional Demand Surges

#ETH

- Institutional Demand: SharpLink Gaming and others are aggressively accumulating ETH, surpassing network issuance.

- Technical Breakout: ETH is testing the $4,000 resistance with bullish MACD convergence and Bollinger Band expansion.

- Price Targets: Analysts project $8K (conservative) to $13K (bullish) by Q4 2025, driven by ETF inflows and DeFi growth.

ETH Price Prediction

ETH Technical Analysis: Bullish Indicators Emerge as Price Tests Key Levels

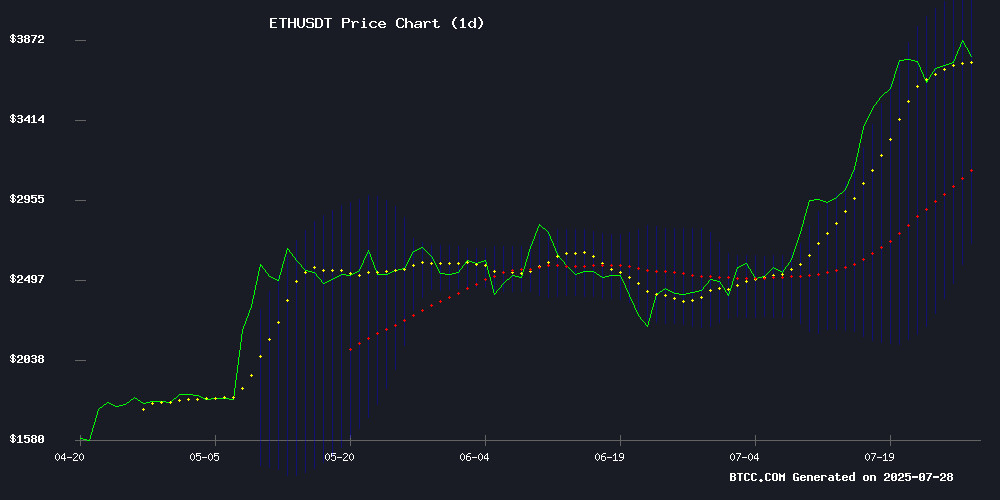

According to BTCC financial analyst John, ethereum (ETH) is currently trading at $3,806.02, showing strong bullish momentum as it tests critical resistance levels. The 20-day moving average (MA) stands at $3,423.84, suggesting a solid support base. The MACD indicator, though still negative at -539.41, shows signs of convergence with the signal line (-503.94), hinting at potential upward momentum. Bollinger Bands indicate volatility, with the upper band at $4,143.97 and the lower band at $2,703.71. A break above the upper band could signal further gains.

Ethereum Market Sentiment: Institutional Accumulation and Bullish Targets Dominate Headlines

BTCC financial analyst John highlights the overwhelmingly bullish sentiment surrounding Ethereum, driven by institutional accumulation and optimistic price targets. SharpLink Gaming's massive ETH purchases, surpassing network issuance, and HashKey Capital's $47M transfer to OKX reflect strong institutional interest. Analysts project ETH could reach $13K by Q4, with $8K as a conservative target. ETF inflows exceeding $1.8B and Vitalik Buterin's roadmap for decentralization further bolster confidence. However, John cautions that the $4,000 resistance remains a pivotal level to watch.

Factors Influencing ETH’s Price

SharpLink's Massive Ethereum Acquisition Surpasses Network Issuance

SharpLink Gaming has executed a landmark transaction in the cryptocurrency market, acquiring 77,210 ETH for $295 million—a volume exceeding Ethereum's net issuance over the past 30 days. The on-chain purchase, completed within a nine-hour window, positions SharpLink as the world's second-largest institutional holder of ETH with $1.69 billion in holdings.

The move underscores Ethereum's evolving scarcity dynamics post-Merge, where EIP-1559's burn mechanism and proof-of-stake transition have enhanced its deflationary characteristics. Analysts suggest this institutional demand, combined with 17 consecutive days of ETF inflows, could propel ETH toward $5,000 by 2025's close.

Market observers note the purchase's timing—during off-peak trading hours—reflects sophisticated execution strategy. The transaction's scale eclipses Ethereum's 72,795 ETH monthly issuance, signaling intensified competition for the asset among institutional players.

Ethereum Tests Critical $4,000 Resistance Amid Bullish Momentum

Ethereum faces a decisive moment as it approaches the $4,000 resistance level, a barrier that has historically capped its price movements. A weekly close above this threshold could signal a breakout toward $4,500–$5,000, while failure may see a retreat to $2,500 support.

The $4,000 mark represents the upper boundary of a long-term trading range that has confined ETH since early 2022. Recent buying pressure, evidenced by above-average volume, suggests bullish sentiment, but confirmation requires a sustained breakout.

Key technical levels include the $2,500 zone, where the Point of Control and 0.618 Fibonacci retracement converge, offering robust support. Market participants remain on edge as Ethereum's next move could define its medium-term trajectory.

SharpLink Gaming Becomes Largest Corporate Ethereum Holder Amid Market Dominance Surge

SharpLink Gaming has acquired an additional 77,210 Ethereum (ETH) worth $295 million, solidifying its position as the largest corporate holder of the cryptocurrency. The firm's total holdings now stand at 438,017 ETH, valued at $1.69 billion. This aggressive accumulation strategy began in July 2025 with a 10,000 ETH purchase from the Ethereum Foundation at $2,572 per token.

Ethereum's market dominance has reached 12%, its highest level in five years, as the asset challenges key resistance levels. The cryptocurrency has posted impressive 60% gains over a 30-day trading period, reflecting strong market momentum. SharpLink's buying spree peaked in late July with a weekly acquisition of 79,949 ETH at an average price of $3,238 per token.

Analyst Predicts ETH Could Surge to $13K by Q4 with $8K as Conservative Target

Pseudonymous crypto analyst "Wolf" has projected a bullish trajectory for Ether (ETH), forecasting a potential rise to $13,000 as early as the fourth quarter. Even under conservative estimates, Wolf anticipates ETH surpassing $8,000—more than double its current valuation. The prediction follows ETH's breakout to new all-time highs, though Wolf cautions investors to brace for a 20%-25% correction post-breakout, describing it as a "final shakeout" before sustained upward momentum resumes.

Institutional interest in ETH appears to be accelerating. SharpLink Gaming (SBET), a Nasdaq-listed firm, has aggressively expanded its ETH holdings, purchasing an additional 77,210 ETH for approximately $295 million this week. The company now holds 438,017 ETH, valued at $1.69 billion, solidifying its position as the largest corporate holder of Ether. This move coincides with the appointment of former BlackRock executive Joseph Chalom as co-CEO and follows the disclosure of 567 ETH earned through staking rewards.

Market sentiment around ETH is shifting, notes Placeholder Ventures partner Chris Burniske, as institutional adoption and staking yields continue to drive demand. The convergence of technical analysis and fundamental growth signals a pivotal moment for Ethereum's market trajectory.

Ethereum’s $4,000 Resistance: A Pivotal Moment for Bullish Momentum

Ethereum faces a decisive test at the $4,000 resistance level, with market indicators suggesting a potential breakout toward $6,000 or a retreat to $3,500. The MACD indicator flashes bullish signals, with the 12-period line firmly above the 26-period signal line, reinforcing upward momentum.

Trading volume surged 62.14% to $96.26 billion, reflecting intensified investor interest. A successful breach of $4,000 could propel ETH to new all-time highs, while rejection may trigger a corrective phase. Market participants await the next move with heightened anticipation.

HashKey Capital Moves $47M in Ethereum to OKX, Sparking Sell-Off Concerns

Ethereum's rally shows signs of fatigue as institutional players appear to take profits. HashKey Capital transferred 12,000 ETH ($47.18 million) to OKX, a move typically preceding sell orders. The timing precedes the Federal Reserve's rate decision, a potential volatility catalyst for risk assets.

Market analysts note such whale activity often precedes short-term corrections, particularly when macroeconomic uncertainty looms. Ethereum had recently tested $3,900 before retreating, with the market now watching for whether this transfer signals a broader de-risking trend among institutional holders.

Lookonchain's on-chain data reveals the transaction originated from a wallet linked to HashKey, a major crypto investment firm. The transfer coincides with Michaël van de Poppe's technical analysis suggesting Ethereum may be at an inflection point after its recent breakout.

BTCS Inc. Expands Ethereum Holdings to $270 Million Amid Strategic Growth

BTCS Inc. has aggressively increased its Ethereum reserves, adding 14,240 ETH to reach a total of 70,028 tokens. At current prices near $3,850 per ETH, the position is now valued at approximately $270 million.

The Nasdaq-listed company raised $207 million in 2025 through a hybrid DeFi/TradFi strategy designed to maximize ETH exposure while limiting shareholder dilution. This approach combines decentralized finance mechanisms with traditional capital markets efficiency.

Separately, BTCS secured $10 million through convertible note financing priced at a premium to market rates. Proceeds will fund expansion of blockchain infrastructure operations.

SharpLink Gaming Nears 500,000 ETH Milestone with $295M Purchase

SharpLink Gaming has significantly bolstered its Ethereum reserves with a $295 million acquisition, bringing its total holdings to 438,017 ETH—edging closer to a 500,000 ETH target. The move, detected by blockchain analysts, positions the firm as the second-largest corporate holder of ETH, trailing only BitMine Immersion.

The newly acquired ETH was staked in batches via Figment, a institutional staking infrastructure provider. SharpLink's aggressive accumulation strategy appears to be paying off, with its stock (SBET) surging 120% over the past month.

This transaction marks the first major move under new leadership, following the appointment of Joseph Chalom as Co-CEO. The market is clearly rewarding SharpLink's conviction in Ethereum's long-term value proposition.

Ethereum Price Could Hit $4,000 as ETF Inflows Surge Past $1.8 Billion

Institutional confidence in Ethereum reaches new heights as ETF inflows skyrocket to $1.846 billion in a single week, marking the second-highest weekly inflow on record. The cryptocurrency now trades at $3,888, boasting a $468 billion market capitalization after a 10% surge over four days.

BlackRock, Fidelity, and Grayscale lead the charge among nine active Ethereum ETFs, with daily inflows consistently exceeding $200 million. The July 22 inflow of $533.8 million stands as the week's peak, followed closely by $452.8 million on July 25.

Market analysts now see $4,000 as an imminent price target, with the current momentum suggesting this threshold could be breached before month's end. The dramatic inflow increase compared to early July signals growing institutional acceptance of Ethereum as a core investment asset.

Vitalik Buterin Explains How Ethereum Will Reach Millions Without Going Centralized

Ethereum co-founder Vitalik Buterin outlined a dual-path strategy for scaling the blockchain while preserving its decentralized ethos. The network must achieve mass usability through technological upgrades while maintaining neutrality and censorship resistance—qualities that distinguish it from traditional financial systems.

Layer 2 solutions like ZK-rollups and stateless clients are already reducing computational burdens, allowing both high-throughput processing and broad participation in verification. "Ethereum's value proposition hinges on being credibly neutral," Buterin emphasized during a recent podcast appearance, framing scalability and decentralization as complementary rather than competing priorities.

Clearmatics Unveils DeFi Derivatives Platform for Custom Futures Contracts

Clearmatics, a pioneer in blockchain-based financial instruments, is launching a novel decentralized futures product called forecast markets. These on-chain derivatives allow traders to create contracts tied to any public time series data—from crypto indexes to climate metrics—blurring the lines between traditional finance and prediction markets.

The platform will operate on Autonity, an upcoming Ethereum-compatible layer-1 blockchain, using its Autonomous Futures Protocol (AFP). CEO Robert Sams emphasizes AFP's permissionless design: "Any measurable trend—GDP, inflation, even blockchain metrics—can become a tradable instrument if market participants demand it."

A "Forecastathon" event next month will onboard quants and developers to build prototype products, signaling Clearmatics' ambition to expand DeFi's reach beyond cryptocurrency speculation into broader financial and environmental markets.

Is ETH a good investment?

Based on current technical and fundamental factors, Ethereum (ETH) presents a compelling investment opportunity. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | $3,806.02 |

| 20-Day MA | $3,423.84 |

| MACD | -539.41 (Converging) |

| Bollinger Bands | $4,143.97 (Upper) / $2,703.71 (Lower) |

John notes that institutional accumulation, ETF inflows, and bullish price targets ($8K-$13K) align with technical breakout potential. However, the $4,000 resistance must be decisively breached for sustained upside.